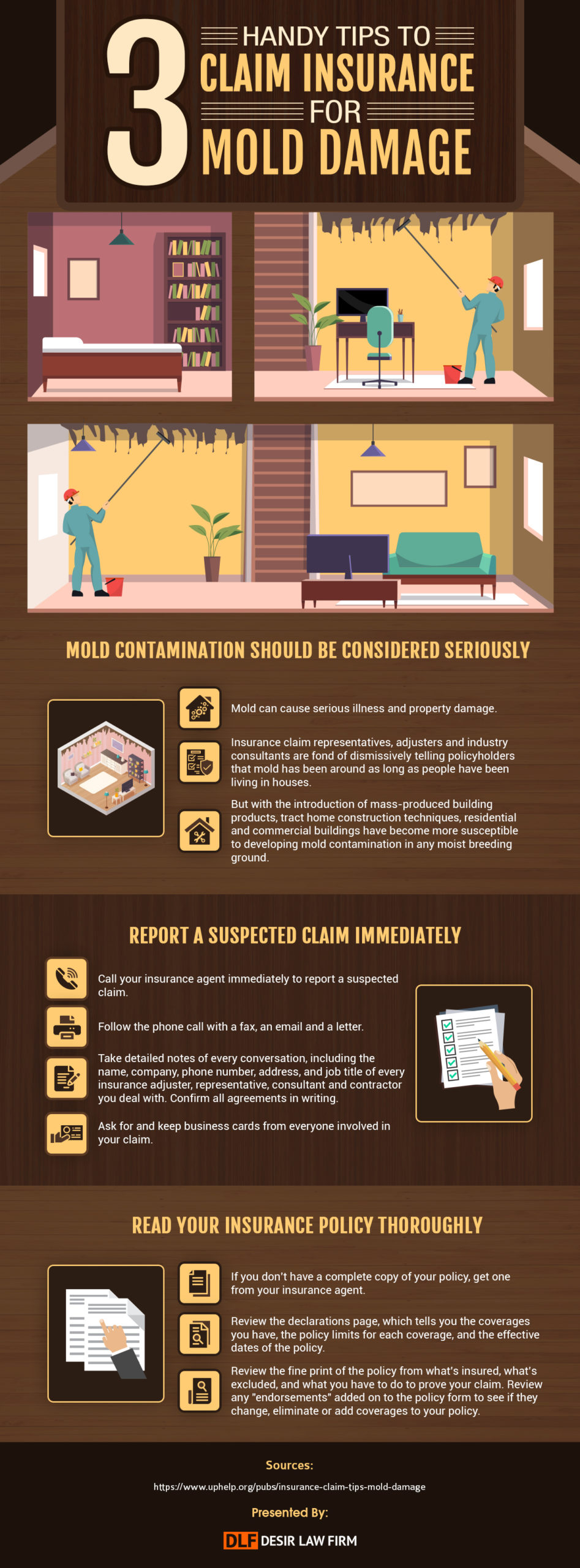

3 Handy Tips to Claim Insurance for Mold Damage

This info-graphic titled ‘3 Handy Tips to claim insurance for Mold Damage’ provides us some tips for mold damage claims. Most of the homeowners don’t give a thought to mold spores until it becomes a problem. And then you may be surprised what is and isn’t covered by your homeowners insurance policy. Time is the biggest problem in case of recovering a mold claim. The longer it sits, the more it grows. The more it grows, the tougher it becomes to deal with. Thus, the key way to prevent its growth is to identify it before it has the chance to spread.

Review your property insurance policy carefully. Most of these policies include exclusions such as long-term seepage or leakage, pre-existing damage, wear and tear, and neglect after the loss is discovered. Your insurance company then covers the additional cost to re-mediate the mold contamination, whenever, mold contamination develops as a secondary problem from water damage that is covered.

For more detail, please refer to the info-graphic below.